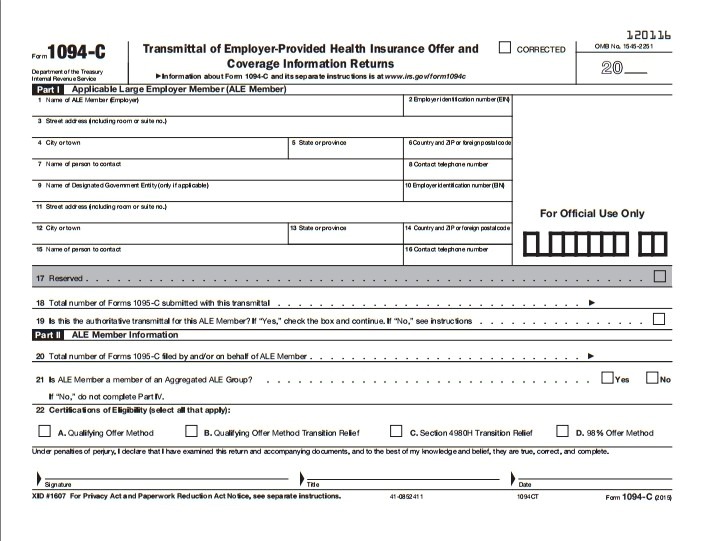

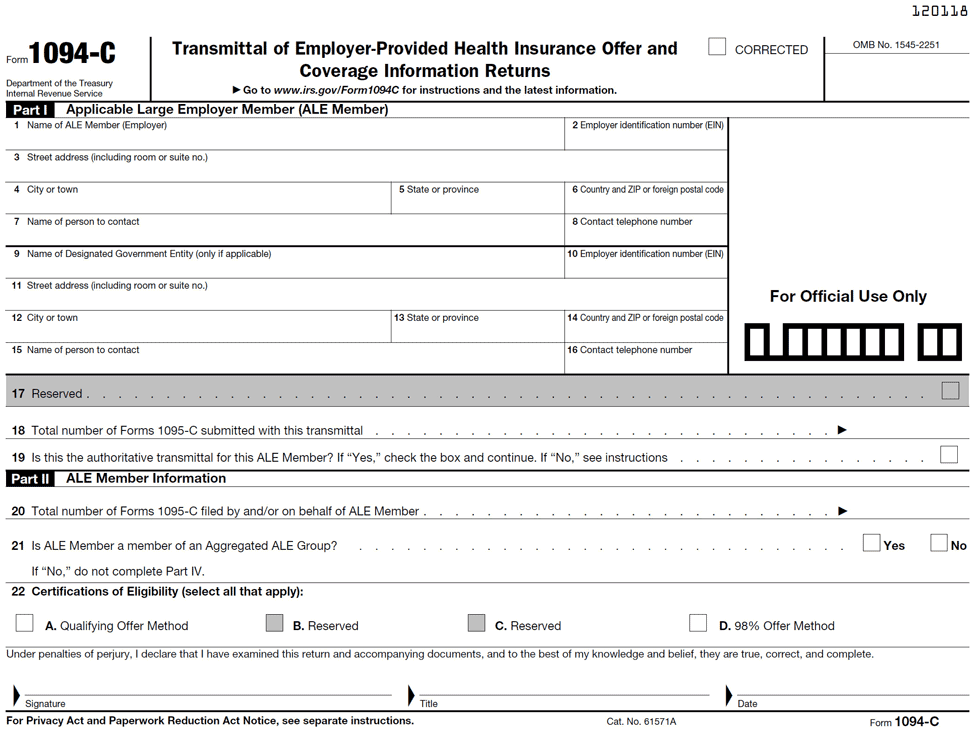

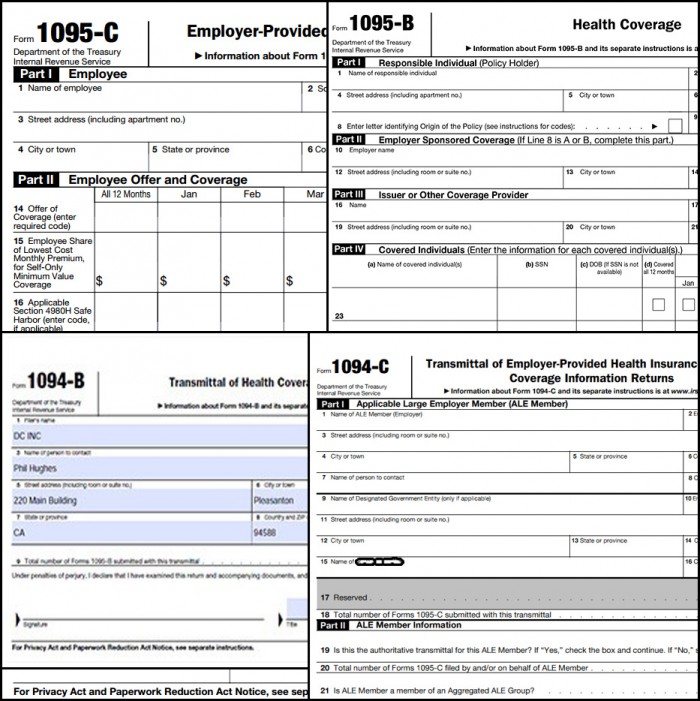

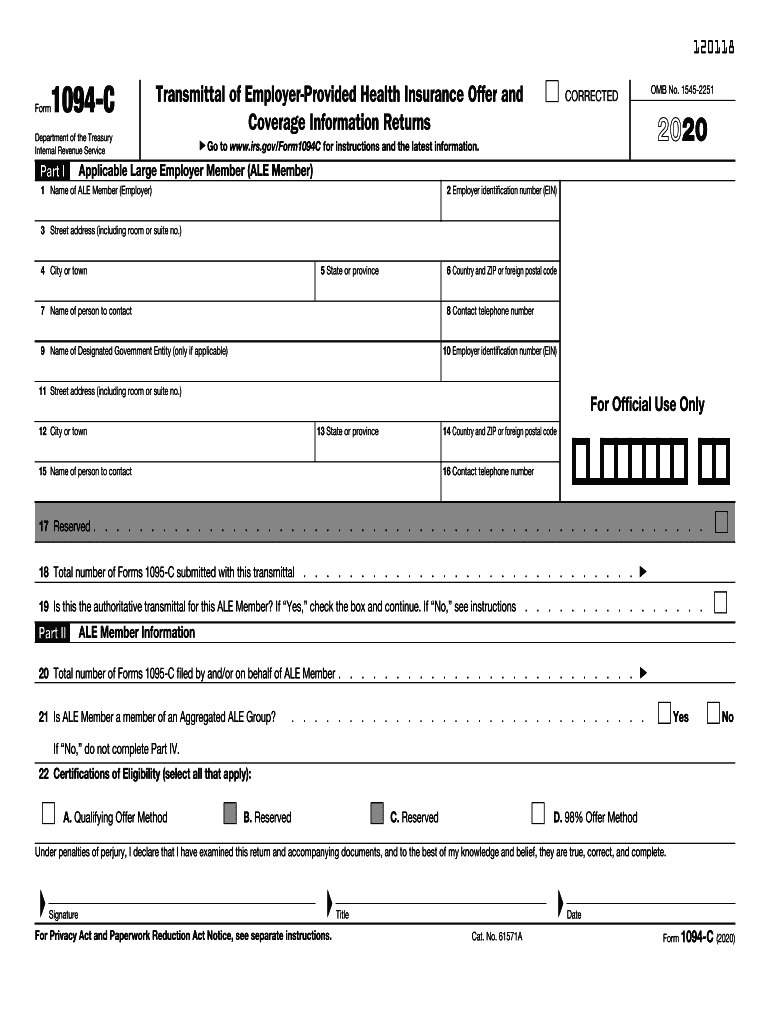

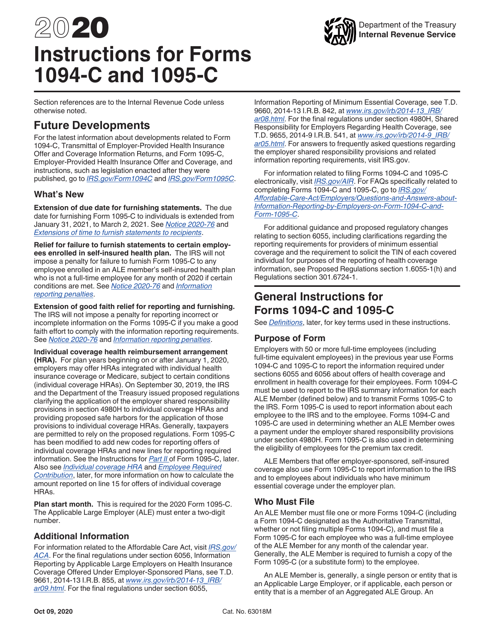

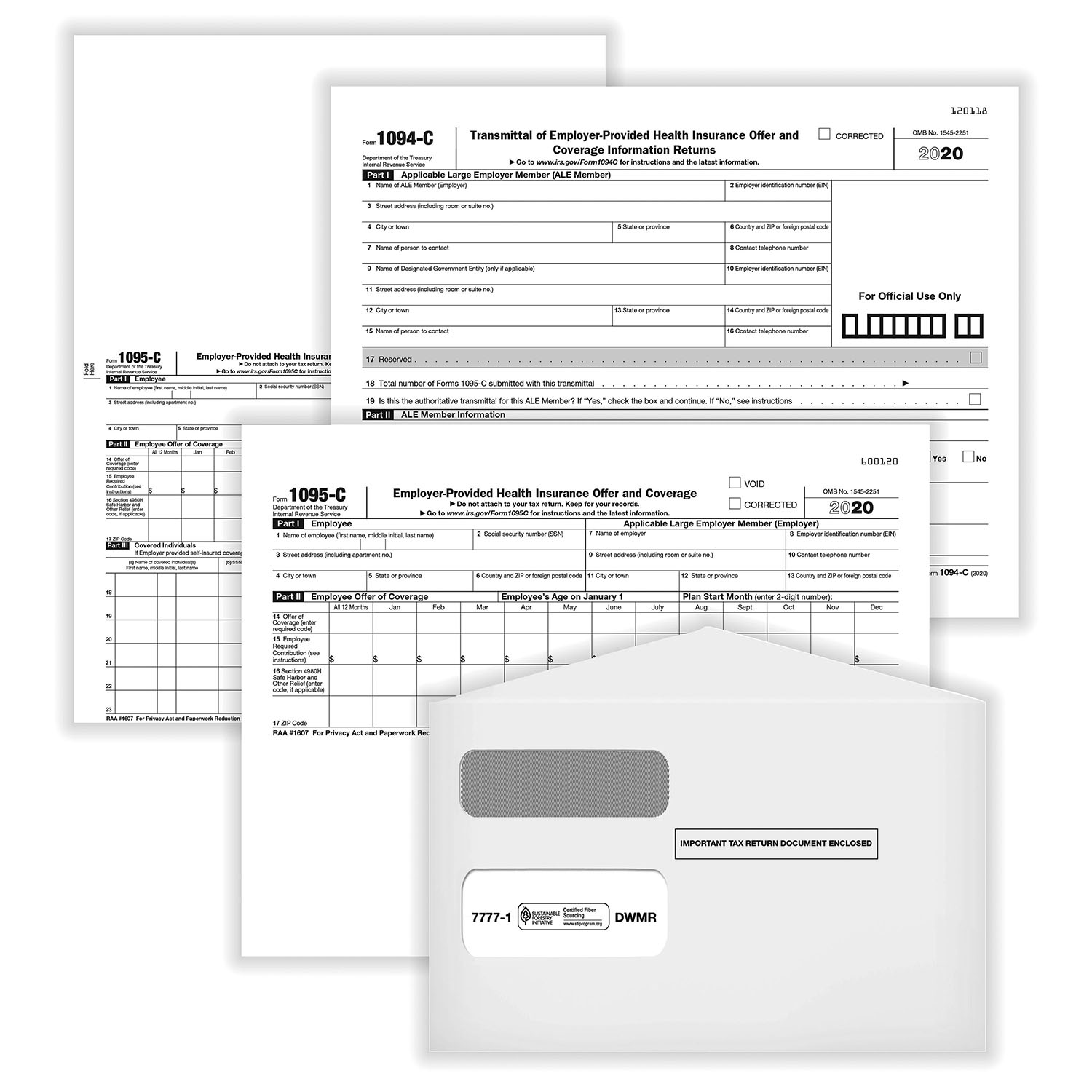

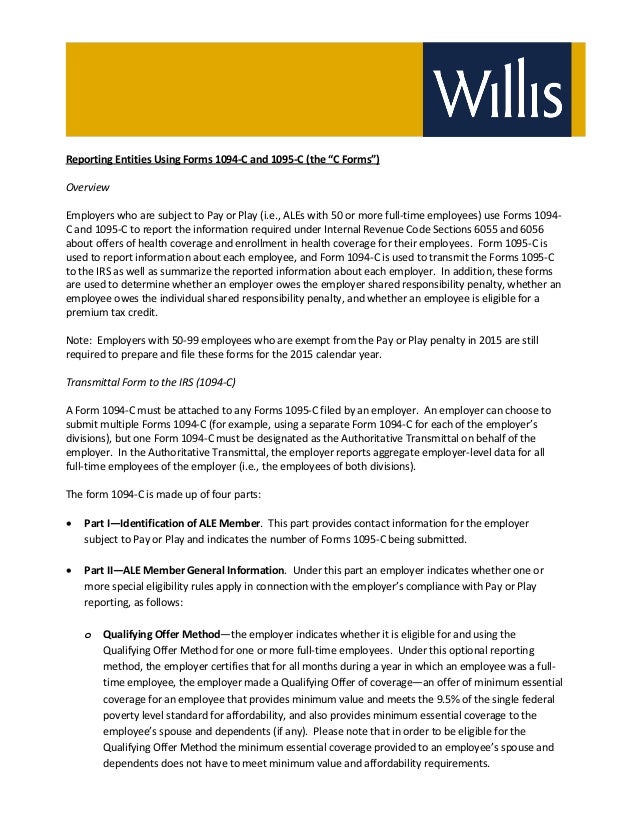

Safety How works Test new features Press Copyright Contact us CreatorsPart I Applicable Large Employer Member (ALE Member) Line 9 Name of designated Government Entity (only if applicable) In Line 9, Begin with the complete name of DGE If you are a DGE filing on behalf of an ALE, use Lines 916 to enter the DGE information If you're NOT a Designated Government Entity (DGE) filing1094C and 1095C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their employees Form 1094C must be used to report to the IRS summary information for each ALE Member and to transmit Forms 1095C to the IRS Form

Form 1094 Instructions Employers Need For The Aca Reporting Deadline

What is form 1094-c used for

What is form 1094-c used for-Back to 1094C Form Guide ;Irs issues aca 18 forms 1094c and 1095c, instructions, and 226j for 16 Description The IRS has issued the final instructions and 1094/1095C instructions for the 18 reporting year, to be filed and furnished in 19

1095 Software Ez1095 Affordable Care Act Aca Form Software

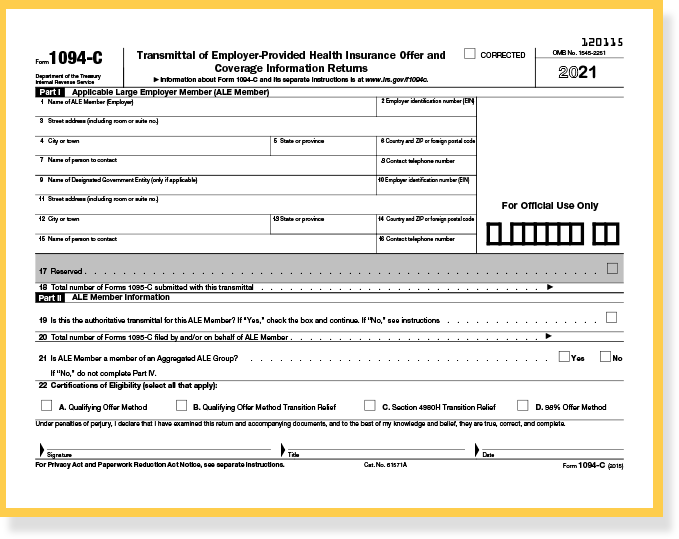

IRS Issues Draft ACA Reporting Instructions for 21 Joanna KimBrunetti The IRS recently released its draft 1094C and 1095C instructions for the 21 tax year We've identified the changes below It appears that Form 1094C will remain the same, but Read MoreForm 1094c instructions 21 Reap the benefits of a electronic solution to develop, edit and sign contracts in PDF or Word format on the web Transform them into templates for multiple use, incorporate fillable fields to collect recipients?ERG HR Half Hour Matt Vaadi will walk you through Employer Mandate Reporting and How to fill out the 1094C and 1095C documents for the ACA Employer Mandat

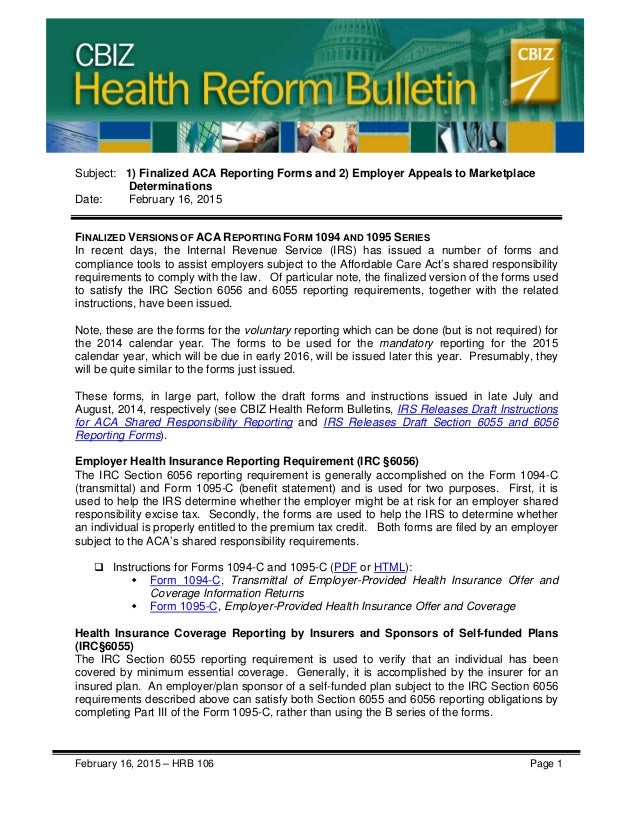

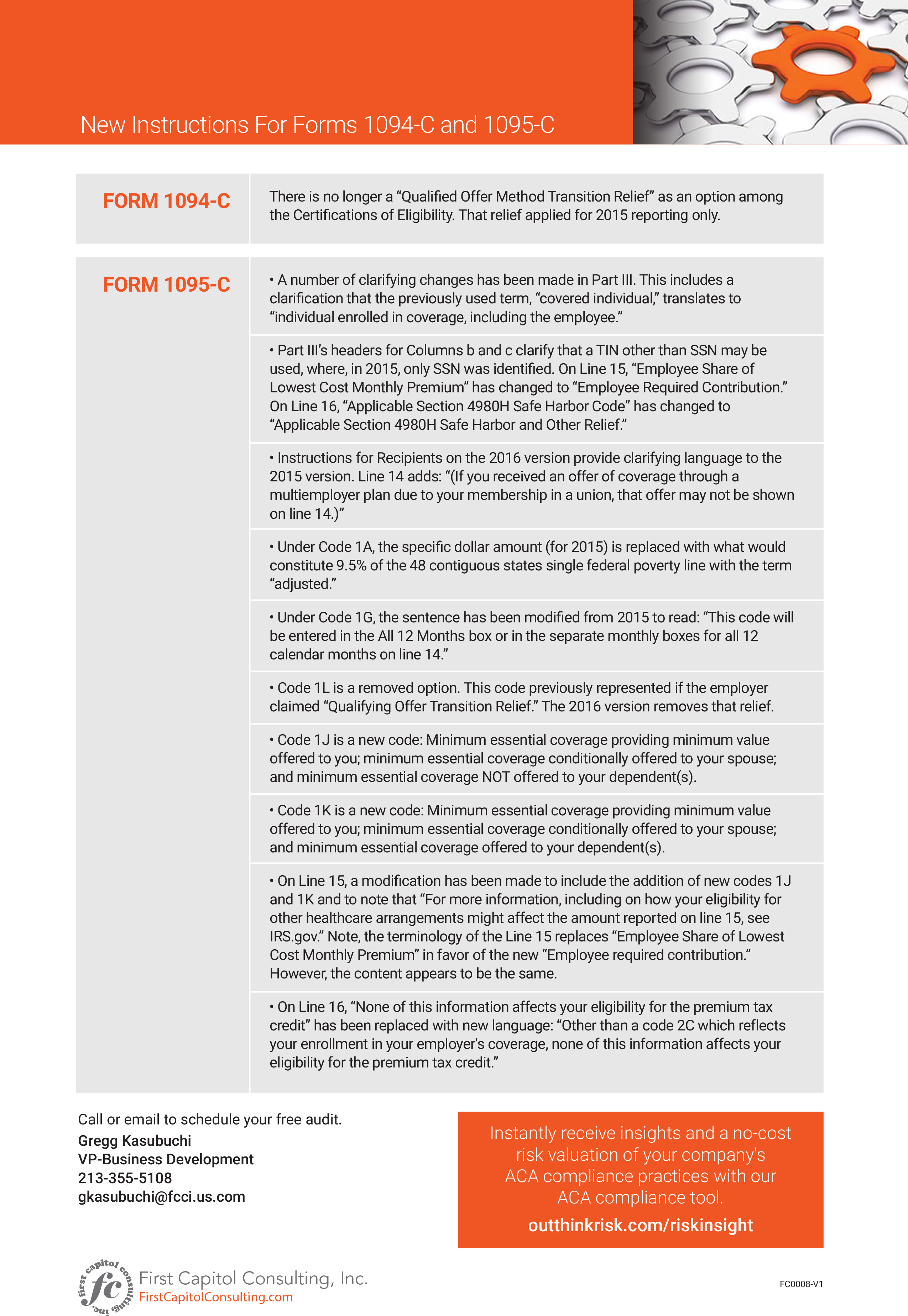

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy &The IRS recently released final Forms 1094 and 1095 (B and C) and instructions related to IRC Sections 6055 and 6056 reporting The 18 forms and instructions appear to have no substantial changes from the 17 versions As a reminder, Forms 1094B and 1095B (the forms used for Section 6055 reporting) are required of insurersBForm Instructions CForm Instructions The IRS has released final Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the tax year As a reminder, the B Forms are filed by minimum essential coverage providers (mostly insurers and governmentsponsored programs, but also some selfinsuring employers

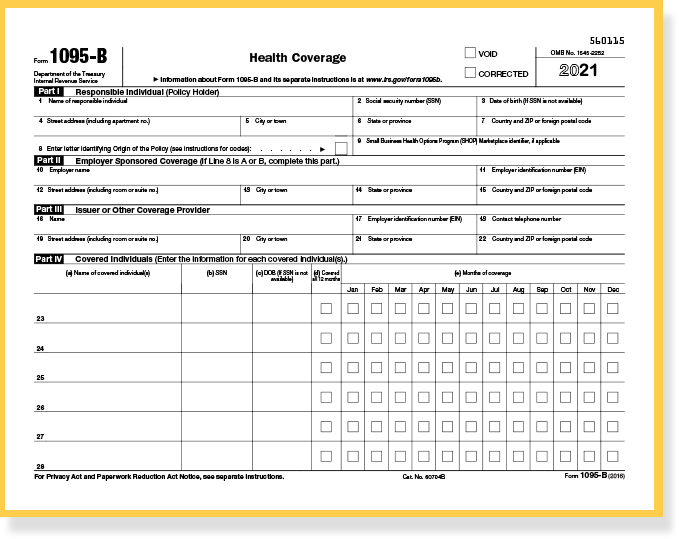

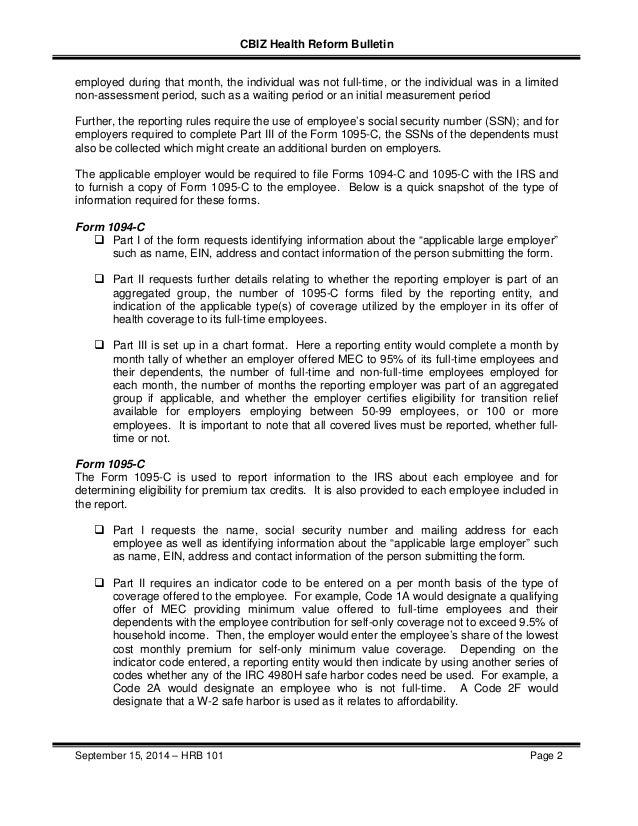

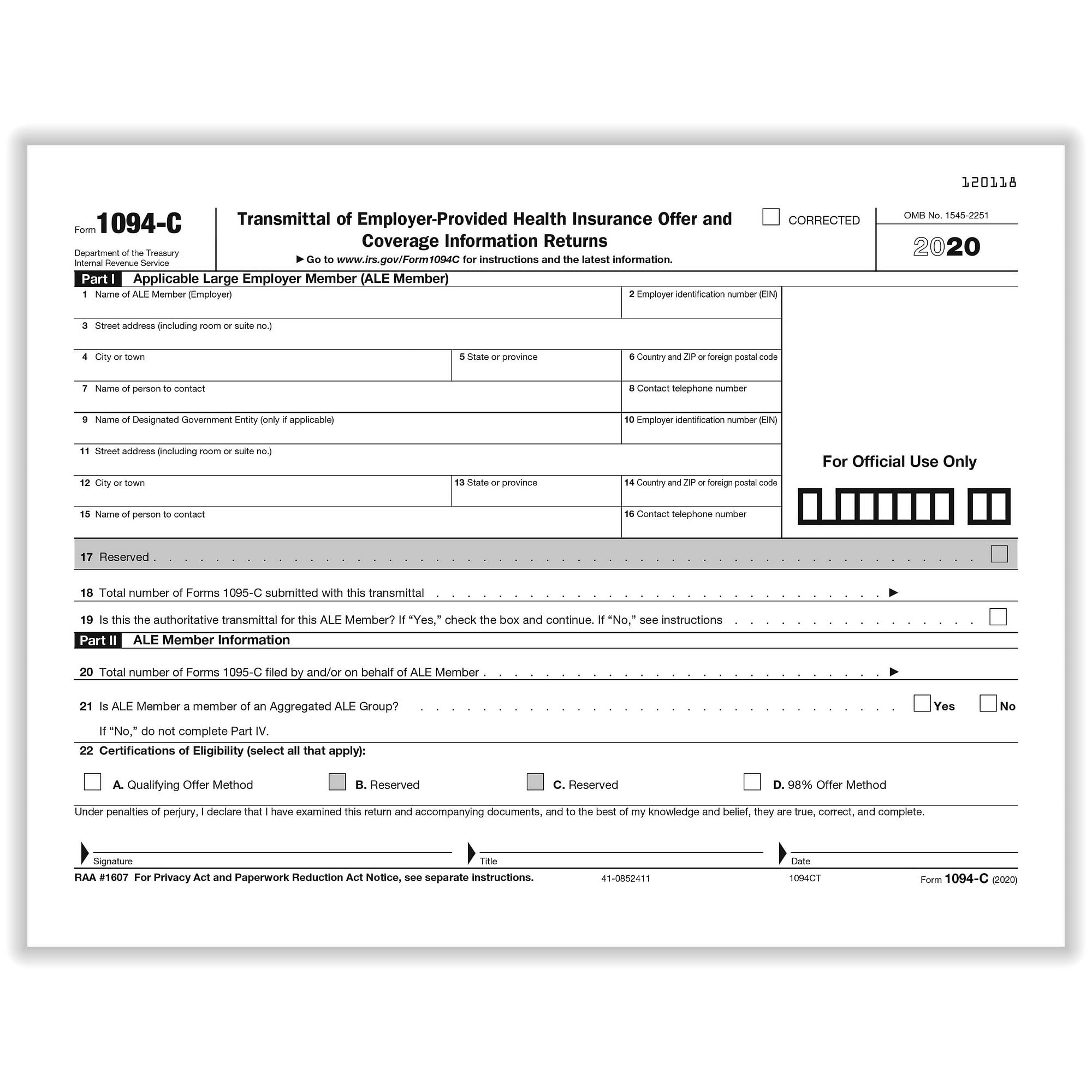

If you are a DGE that is filing Form 1094C, a valid EIN is required at the time the return is filed If a valid EIN is not provided, the return will not be processed If the DGE does not have an EIN when filing Form 1094C, it can get an EIN by applying online at IRSgov/EIN or by faxing or mailing a completed Form SS4 See the Instructions for Form SS4 and Pub 1635Form 1094C is a coversheet that must accompany every Form 1095C a reporting employer sends to the IRS 36 37 If you find yourself sending a Form 1094C, without attaching Forms 1095C, to the IRS, you are doing it wrong 37C Form Instructions The IRS has finalized Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 18 tax year As a reminder, the B Forms are filed by minimum essential coverage providers (mostly insurers and governmentsponsored programs, but also some selfinsuring employers and others) to report coverage

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

Irs Releases Instructions And Draft Form 1094 C And 1095 C Basic

Back to 1094C Form Guide ;Information about Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, including recent updates, related forms, and instructions on how to file Form 1094C is the transmittal form that must be filed with the Form 1095CApplicable Large Employers (ALEs), or employers with 50 fulltime employees in the previous year, must file Form 1094C when

Adp Com

1094 C Form Transmittal Zbp Forms

Forms 1094 and 1095 and instructions have also been released These forms are used by insurance carriers and other health coverage providers to report Minimum Essential overage ("ME "), including small employers with selffunded plans not subject to the A A employer mandate Employers with selffundedPlan start month Age If the employee was offered an ICHRA, enter the employee's age onC Form Instructions The IRS has released final Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 19 tax year No material changes have been made to the forms, either from prior years or from the drafts released in November (see our Checkpoint article ) (The "Instructions for Recipient" included with Form

Form 1095 A 1095 B 1095 C And Instructions

Aca Forms 1094 C And 1095 C And Reporting Instructions For The Aca Times

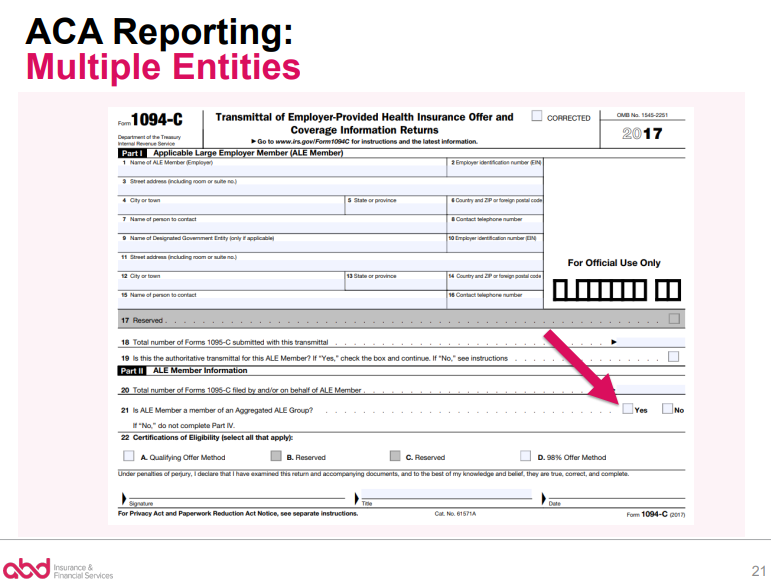

Specific Instructions for Form 1094C Return to top Part I—Applicable Large Employer Member (ALE Member) Line 1 Return to top Enter employer's name Line 2 Return to top Enter the employer's EIN An SSN may not be entered in lieu of an EIN Enter the 9digit EIN including the dash If you are filing Form 1094C, a valid EIN is requiredInst 1094C and 1095C Instructions for Forms 1094C and 1095C Form 1095A Health Insurance Marketplace Statement 21 Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement Form 1095BPart II ALE Member Information Line Total number of Forms 1095C filed on behalf of ALE Member In Line , enter the the total number of 1095C Forms that will be filed by the employer This includes 1095C Forms accompanying this Form 1094C, as well as any other 1095C Forms filed with different 1094C Forms under the same employer

1094 C 1095 C Software 599 1095 C Software

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

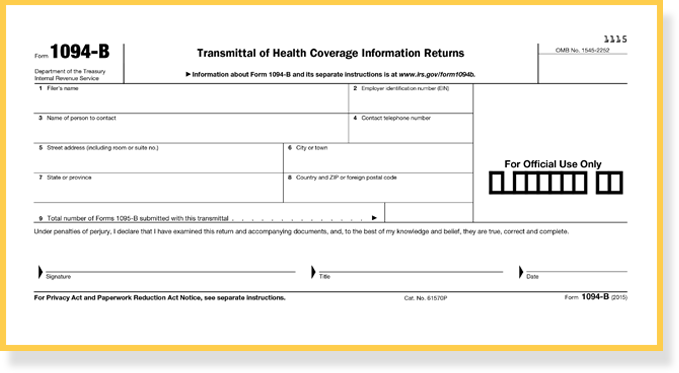

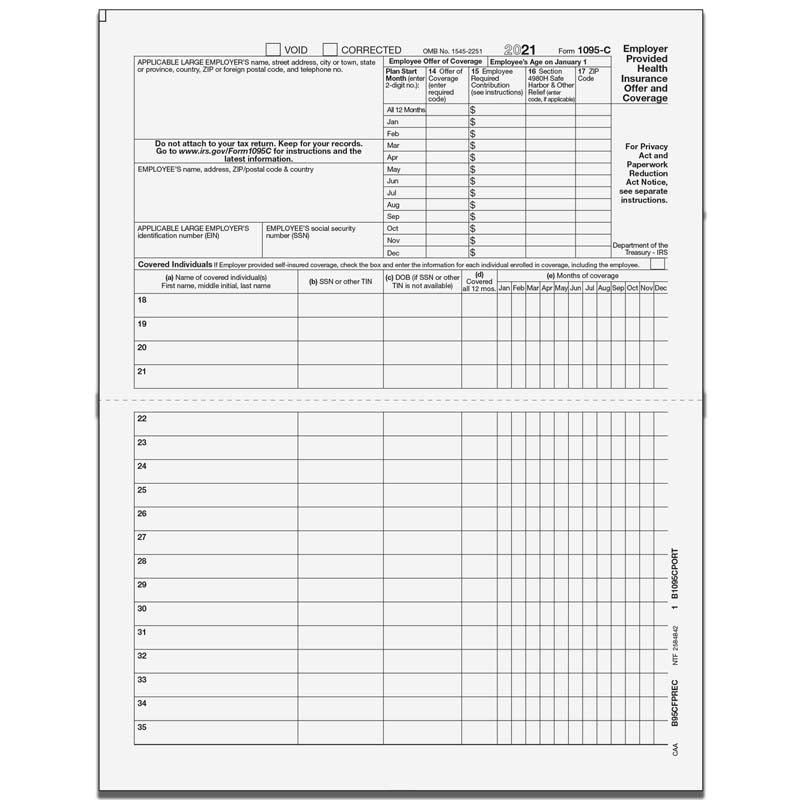

Form 1095C is a new form designed by the IRS to collect information about ALEs and the group health coverage, if any, they offer to their fulltime employees Employers provide Form 1095C (employee statement) to employees and file copies, along with Form 1094C (transmittal form), to the IRS Form 1095C is comprised of three partsThe remainder of the article discusses the changes made to the iteration of the Form 1094C and 1095C instructions Changes That Apply to All Employers Plan Start Month The largest change made to the instructions isData, put and request legallybinding digital signatures Get the job done from any gadget and share docs by email or fax

1095 Software Ez1095 Affordable Care Act Aca Form Software

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

Understanding Part II and Part III for Form 1094C (16) Part II 22a Qualifying Offer Method To be eligible to use the Qualifying Offer Method for reporting, the employer must certify that it made a Qualifying Offer to one or more of its fulltime employees for all months during the year in which the employee was a fulltime employee for whom an employer shared responsibility paymentEnter a term in the Find Box Select a category (column heading) in the drop down Click Find ClickA Form 1094C designated as the Authoritative Transmittal, whether or not filing multiple Forms 1094C), and must file a Form 1095C for each employee who was a fulltime employee

1094 C 1095 C Software 599 1095 C Software

2

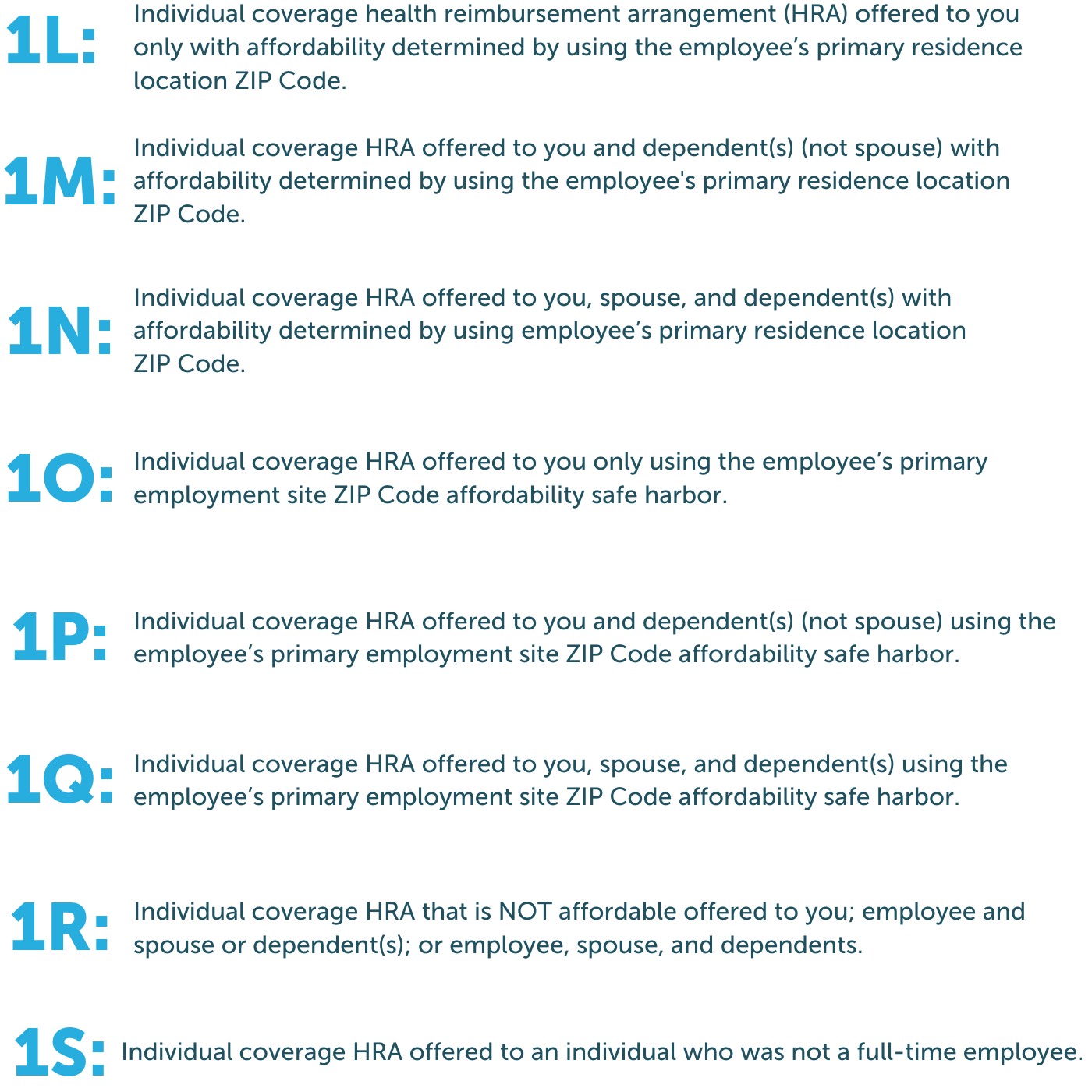

Back to 1094C Form Guide ;Draft C Form Instructions The IRS has released draft Affordable Care Act (ACA) information reporting forms and instructions for 21 As a reminder, Forms 1094B and 1095B are filed by minimum essential coverage providers (insurers, governmentsponsored programs, and some selfinsuring employers and others) to report coverage information in2 Instruction to complete Part II, Employee Offer of Coverage of Form 1095C The IRS has recently made some changes in Form 1095C related to ICHRA plan So, before entering into the lines, employers need to fill the employee's age &

Understanding Part Ii And Part Iii For Form 1094 C 15 Boomtax Knowledge Base

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

John Barlament walks through how to fill out IRS forms 1094C and 1095C This presentation was given to selffunded employers at an Alliance Learning CircleForm 1095C Line by Line Instructions Updated on 1030am by, TaxBandits IRS Form 1095C is used by Applicable Large Employers (ALEs) to report the health insurance coverage information provided to their fulltime employees and employee's dependents For the tax year , form 1095C has been updatedLast week, the IRS issued it updated Form 1094C and 1095C instructions for 19 Employers that employ New Jersey residents, however, may have more reading to do New Jersey responded to the federal repeal of the Affordable Care Act's (ACA)

1095 Software Aca Software 1095 Reporting

Good Sense Guide To Minimum Essential Coverage Forms 1094 C And 1095 C Ca Benefit Advisors Arrow Benefits Group Complex Questions Straight Answers

Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 21 Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement 21 Form 1095A Health Insurance Marketplace Statement 21 Form 1095CWhat is the Form 1094C?Form 1094C Transmittal of EmployerProvided Health Insurance Offer &

Irs Releases Draft 19 Aca Reporting Forms And Instructions Sequoia

1

# Publication 35B, California Instructions for Filing Federal Forms 1094B and 1095B # Publication 35C, California Instructions for Filing Federal Forms 1094C and 1095C Checkbox on Form 540/Form 540NR/Form 540 2EZ for fullyear health care coverage You will check the "Fullyear health care coverage"Part III ALE Member Information Monthly Line 23 to Line 25 ALE Member Information Reminder Part III (Lines 2335) should only be completed on the Authoritative Transmittal for the employer In Column (a), if you offered Minimum Essential Covertage (MEC) to at least 95% of your fulltime employees and their dependents, enter X inIf you are filing Form 1094C, a valid EIN is required at the time it is filed If a valid EIN is not provided, Form 1094C will not be processed If you do not have an EIN, you may apply for one online Go to IRSgov/EIN You may also apply by faxing or mailing Form SS4 to the IRS See the Instructions for Form SS4 and Pub 1635

What Payroll Information Prints On Form 1095 C To Employees

2

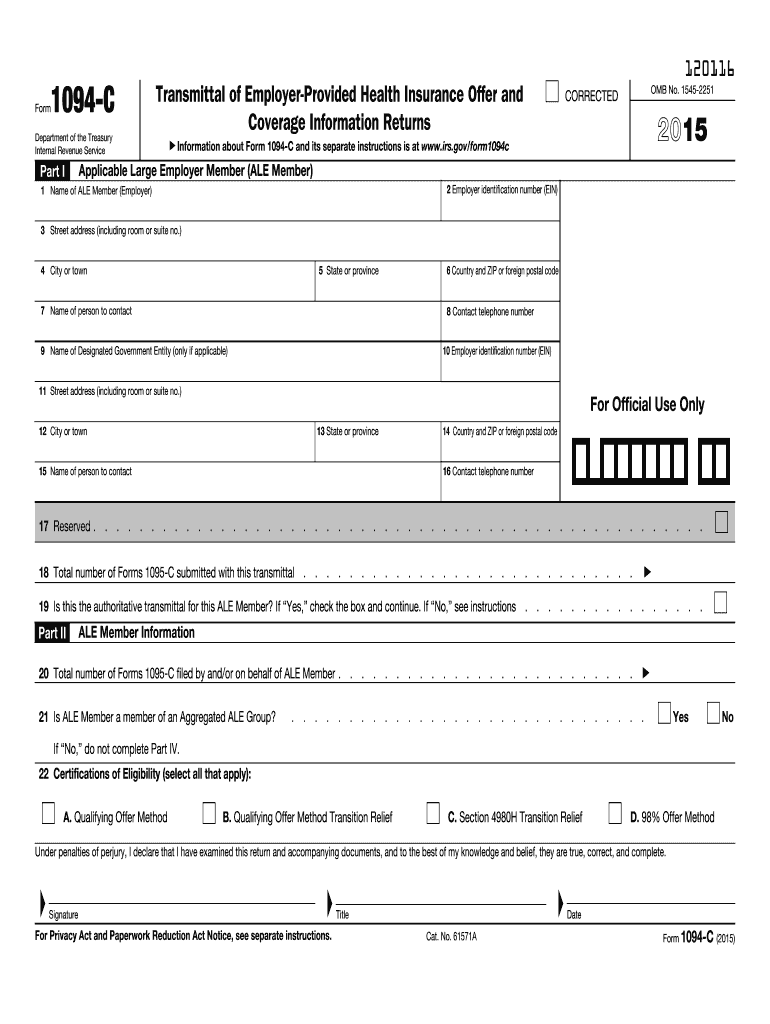

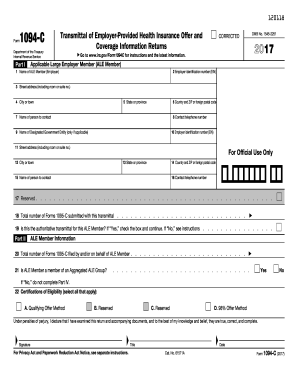

Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printing Downloading and printing File formats View and/or save documentsC Form Instructions The IRS has released final Forms 1094C and 1095C (C Forms) and final instructions for the C Forms for the 17 tax year (Final Forms 1094/1095B, but not the instructions, have also been released We'll cover those items in a separate article after the final instructions become available)Final instructions for both the 1094B and 1095B and the 1094C and 1095C were released in September 15, as were the final forms for 1094B, 1095B, 1094C, and 1095C Form 1094C Form 1094C is used in combination with Form 1095C to determine employer shared responsibility penalties It is often referred to as the "transmittal form

What Information Do Ale Members Need To Complete The Authoritative Transmittal And Submit It To The Irs

Affordable Care Act Electronic Filing Instructions

This is the Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns This is a long name for a short form The Form 1094C the authoritative transmittal, in other words it is basically a cover page for the Form 1095C that briefly summarizes the information within these formsIf a substitute form is used, this form must meet all the content requirements of the IRS and should include every piece of information needed for Form 1094C and Form 1095C In 17, the IRS provided draft instructions for forms 1094, 1095, and other forms required for ACA reporting1094c instructions Complete documents electronically working with PDF or Word format Make them reusable by generating templates, include and fill out fillable fields Approve documents with a legal electronic signature and share them by way of email, fax or print them out Save blanks on your computer or mobile device Increase your productivity with powerful solution!

trix Affordable Care Act Aca Forms

Health Reform Bulletin Finalized Aca Reporting Forms Employer Appe

Reporting on Form 1095C The Instructions for Forms 1094C and 1095C contain further information on reporting options for government entities GovernmentSponsored Programs The following governmentsponsored programs are minimum essential coverage 1 Medicare Part A 2 Medicaid, except for the following programs aSee page 15 of form instructions for more information 17 For IRS use, skip this line 18 Enter the total number of 1095C forms submitted with this 1094C form Unless you are submitting 1095C forms in batches and using multiple forms 1094C this number will generally correspond to the total number of 1095Cs you are submitting overallForm 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Return Filing is optional for CY 14, but required for Coverage Years starting in 15 All Applicable Large Employer (ALE) Members are required to file Forms 1094C and 1095C for Coverage Years starting in 16

Reporting Enrollment Information For Self Insured Coverage For An Individual Not An Employee On Any Day Of The Calendar Year 1g Integrity Data

Irs Releases Forms 1094 1095 And Related Instructions Including New Rules For Ichra Reporting

Editor's Note Since the publishing of this article, the IRS and US Treasury extended reporting deadlines for ALEs filing certain forms related to the ACA, including Form 1094C The new deadlines for employers to file Form 1094C are if filing by paper and if filing electronicallyCoverage Information Returns Form 1094C is considered as the transmittal Form of Form 1095C and it is used by the employers to report to the IRS Who Needs to File?Forms 1094C Federal instructions regarding Authoritative Transmittal are not applicable for California purposes Information on federal Form 1094C, line 19, is not required by the FTB When To File You will meet the requirement to file federal Forms 1094C and 1095C if the forms are properly addressed and mailed on or before the

Corpsyn Com

2

Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1094CLikewise, Form 1094C is used as a "cover sheet" of sorts for each organization's collection of 1095Cs and includes The number of employees in an organization The number of 1095C forms that are being filed A direct contact The employer, including contact information and the organization's EIN IRS Issues Draft Form 1095C for18 Form 1094C/1095C Instructions – Penalties for reporting failures and errors will increase to $270 per violation up to an annual maximum of $3,275,500 Please note Penalty limits apply separately to IRS information returns and individual statements Form 1095C must be sent out to employees by

Form 1095 A 1095 B 1095 C And Instructions

New Instructions For Forms 1094 C And 1095 C An Infographic The Aca Times

Updated Irs Reporting Requirements Babb Insurance

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

2

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

trix Irs Forms 1094 C

Irs Extends Deadline For Employers To Furnish Forms 1095 C And 1095 B Chicago Employee Benefits Byrne Byrne And Company

2

Irs Form 1095 C Codes Explained Integrity Data

1

2

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

17 01 11 12 59 1094 C 1095 C Reporting Youtube

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

Streamlined Aca Reporting Methods Newfront Insurance And Financial Services

Health Reform Bulletin Irs Releases Draft Instructions For Aca Shar

Irs Releases Draft 19 Aca Reporting Forms And Instructions Sig

1095 C Preprinted Portrait Version With Instructions On Back

1094 C Transmittal Of Employer Provided Health Insurance 1095c Coverage Info Returns 3 Sheets Form 100 Forms Pack

1094 C Reporting Requirements A Step By Step Guide

Aca Employer Mandate And Reporting Rules When Acquiring A Non Ale Newfront Insurance And Financial Services

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

Tax Form 1094c Tax Form Details With Light Background Stock Photo Download Image Now Istock

Form 1094 Instructions Employers Need For The Aca Reporting Deadline

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Instructions For Forms 1095 C Taxbandits Youtube

Updated Hr S Guide To Filing And Distributing 1095 Cs Bernieportal

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

Form 1094 C Instructions For Employers What You Need To Know

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Irs Releases Final 18 Aca Reporting Forms And Instructions Health E Fx

What Payroll Information Prints On Form 1094 C To The Irs

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

2

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Common Mistakes In Completing Forms 1094 C And 1095 C

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

2

Draft 16 Instructions For Form 1094 C 1095 C Released Boomtax

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Ez1095 Software How To Efile Correction For Both 1095 C And 1094 C

Complyright 1095 C Employer Provided Health Insurance Offer And Coverage Form And Envelopes Bundle For 100 Employees Forms Recordkeeping Money Handling Office Products Vietpro Org Vn

News Flash September 5 14 Irs Releases Draft Pay Or Play Informat

What You Need To Know About Aca Annual Reporting Aps Payroll

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

21 Aca Form 1095 C Line 14 16 Code Sheet By Acawise Issuu

Ez1095 Software How To Print Form 1095 C And 1094 C

1094 C Irs Transmittal For 1095 C Forms For 21 5500 Tf5500

2

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

18 Complyright 1094 C Transmittal Translated Pack Forms 50 Of

Irs Form 1094 C Form 1094 C Online 1095 C Transmittal Form

2

15 Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Form 1095 C Pre Printed Official Irs Form Includes Instructions On The Back

Changes Coming For 1095 C Form Tango Health Tango Health

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Irs Releases Final Reporting Forms The Aca Times

1094 17 Fill Out And Sign Printable Pdf Template Signnow

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

2

15 Forms 1094 B 1095 B 1094 C And 1095 C Benefits Work

Mbwl Aca Prime Employer S Guide To Aca Reporting 1 9 17

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Irs E Filing Deadline March 31 22 Aca Gps

Draft 21 Aca Reporting Forms Issued By Irs The Aca Times

0 件のコメント:

コメントを投稿